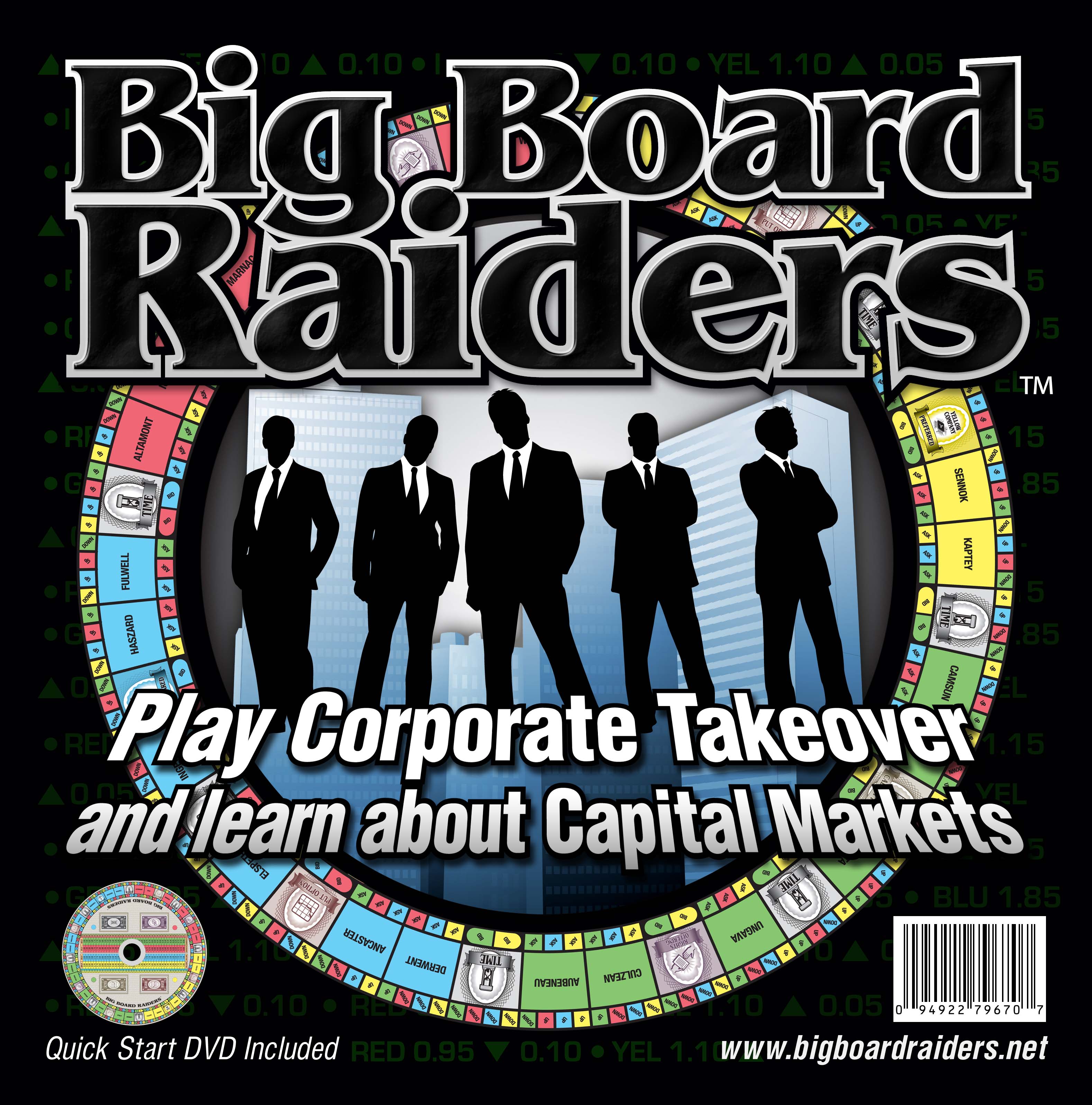

Big Board Raiders

-

Description

From the publisher's website bigboardraiders.net :

I do not have any affiliation with any investment entity and I am not encouraging anyone to invest in anything. This is intended for your entertainment and learning.

I think we all know young boys or girls who seem like they were hard-wired for finance. When the subject of money is being discussed, they are right there like spounges soaking it up. I know because I was one of them, but my parents didn't take the time to teach me about money. Today lots of parents still don't teach their kids enough about money, and yet our kids will all deal with money most days in their lives and how early they begin to understand money, will directly influence their lifestyle. This game is for parents to encourage those little finance prodigies. The world is changing to where the cash in your hand is the crumbs from the table, while the banquet is inside the corporations. For Grade 5 and up, but best for teens and up.

The “Big Board” is like a nickname for Wall Street, while “Raiders” are the teams of entrepreneurs, lawyers, accountants, brokers and investment bankers who engaged in hostile takeovers of the companies they pursue. In Big Board Raiders, players can gang-up by pooling their capital to promote a cause or stop another player, but alliances don’t last forever and when they end, backstabbing is an inevitable strategy. Communication and deal making are very important enhancements to a player’s game strategy. A few choice words can help your portfolio or have the opposite effect on your opponent’s. It’s all about opportunities, timing and the hustle.

There are two main objectives players engage in while playing Big Board Raiders; the first is to get elected by proxy as a director of a company and the second is to grow your portfolio using the many investment vehicles, so that you will have the capital to make your move to control your company; the company in which you were elected to the board by proxy. There are four trading companies: Yellow, Blue, Red, and Green. Six Subsidiaries, and each of these subsidiaries has a proxy vote that it gives to the players as they land on their subsidiary space on the game board. To win, grow your capital while collection the proxy votes to be elected as a director, then buy enough shares to take over control of that company.

New Version 2:

The level system below is version 1 which is in the manual used in the box that is shipped to you. You can still play this game if you choose. There is now version 2, which is an add-on pdf, which is an alternate rule set, not much different, that is downloaded from our website which is a faster game, where some of the restrictions to trading have been lifted, just as the NYSE did before the crash of 2008.

Version 1 is a slower moving game than version 2. All the same game pieces work with either version.We no longer use the level system in version 2 because it was confusing to beginners, just the people it was intended to help. Now there is only a menu of possibilities under two categories, buying and selling. There are also videos on youtube at the bigboardraiders channel and Big Board Raiders on facebook, become a fan and stay in the loop. There is also a number of blogs floating around about how this game is a very good math problem generator for grades 5, 6 and 7 math as well as stock trading game.

In future, we will be publishing new rule sets via our website in pdf format. We can respond to players feedback, suggestions and wishes faster this way.

We will be loading some videos here of the kids playing Big Board Raiders, see you soon. - Patrick Woods, the designer.

Original Version 1 below:

We use a level system to introduce beginners to the world of corporations.

Level 1: Common shares and directorships

Level 2: Preferred shares and dividends

Level 3: Bonds, debentures and interest

Level 4: Short selling, margin and leverage

Level 5: Rights offerings

Level 6: Options trading puts and calls

Each level is another way to invest your money. Players can ascend through the levels in any order, it’s your choice.

Level 1: This is the simplest idea presented. You are trading common shares, which represents the ownership of the corporation. As well, you can become a director of the corporation and draw an annual salary for each directorship you hold. You want to grow your salary by holding lots of these directorships. Note the word “annual” because there is TIME involved, in the form of a payday at year end. Happy New Year.

Level 2: We add a twist to holding common shares. In our game, preferred shares have all the privileges of common shares but there is an added sweetener, dividends at year end.

Level 3: We introduce the idea of debt. The corporations have borrowed money from the public in the form of secured bonds and unsecured debentures. These pay interest to players holding them at the year end.

Level 4: This is probably the one most people don’t know about. Selling short is profiting when the market value of shares falls. You are allowed a margin account which means you are using someone else’s money, and you are introduced to the notion of leverage.

Level 5: Here you are given the opportunity to buy more shares at a discount to market price, if you are a shareholder.

Level 6: This is the last idea. You are buying an option to buy or sell at a specified price. You then have to exercise it on another turn before it expires worthless at the year end. Another form of leveraged, highly volatile investing sometimes called derivatives.

comment

the game is now self-published by the designer Patrick Woods -

Details

Category: EconomicDesigner: Patrick WoodsPublisher: (Self-published), CANUSA Trading IncTime: 120 minutesYear: 2008